And if your company still bases its accounting on papers and/or Excel spreadsheets, then properly chasing down due payments is a cumbersome mess.

However, by upgrading to an online accounting solution it’s possible to kill two birds with one stone: not only will your business’s day-to-day running become smoother thanks to the simplified, real-time accounting process, but there is also the inclusion of intelligent features like debtor tracking.

Spotting debtors with a glance

Debtor tracking with online accounting software is ridiculously easy: not only are all invoices automatically recorded the moment they are created, but a single glance at the visual and highly informative dashboard is more than enough to learn which bills have been paid fully or partially, and which are overdue. Even though the dashboard of accounting solutions displays overdue amounts as a single total, invoices can be viewed individually as well to see exactly when unpaid invoices became due, the respective amounts that are owed to you, and – in certain cases – whether the invoice has been opened by the debtor or not.

Visiting the invoices section in your software is also beneficial due to the fact that the moment an invoice is paid by the debtor the payment can be recorded and reconciled with the matching transaction. The accounting program keeps track of all incomes and expenses, too – also conveniently displayed on the dashboard – meaning that the debtor’s payment will never go unnoticed.

The tricks for getting paid

Being able to see the overdue amounts and unpaid invoices is a good thing, but it isn’t worth a nickel if you can’t chase down debtors properly. Thankfully, most online accounting programs are prepared for these situations and have plenty of solutions up their sleeve to urge debtors to pay as soon as possible.

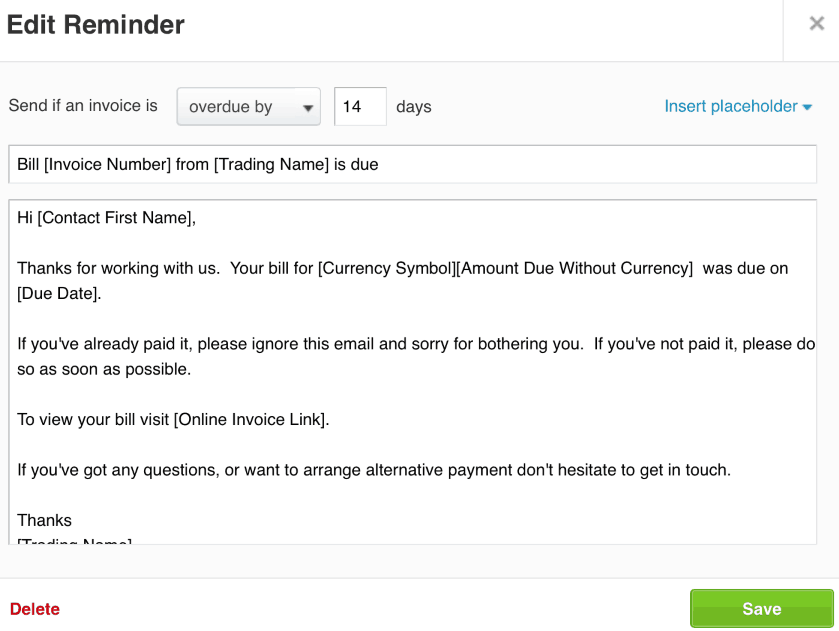

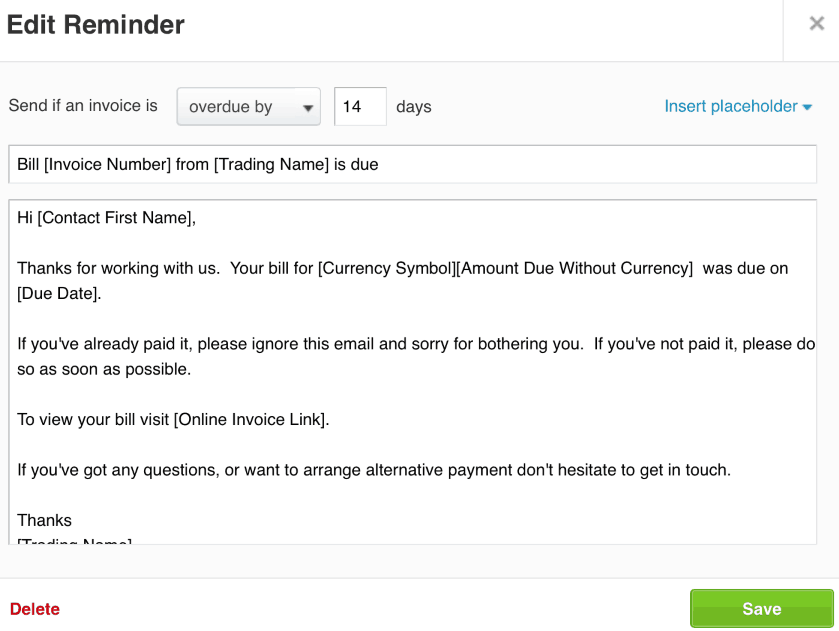

Payment reminders

Invoice payment reminders are automated messages sent at determined intervals after the issuing of the invoice, asking the client to pay whatever amount owed by them. There are better ways to create an effective reminder, but the main focus is to be stern yet polite, setting a narrowed deadline and applying late payment fees on overdue invoices – with the option of discounts if the invoice is paid in time. And if that doesn’t help either, it’s best to ask the client – maybe not being able to pay is through no fault on their own.

Fast payment

The main reason behind not getting paid in time is usually the lack of any instant payment options. Nobody likes to visit their bank to send a check or initiate a bank transaction, as both options take a significant amount of processing time. But if the client was able to pay immediately, your overdue invoices would disappear in an instant.

Thankfully many online accounting solutions offer the option to place buttons on your invoices with which clients can pay quickly with credit/debit card or PayPal the moment the bill is received. Although the fast payment option is usually an extra service, it’s more than worth its price if you’d like to get paid in time.

Third party integration

The beauty of online accounting solutions is that there is no need to worry if neither fast payment nor payment reminders are available, since these features can be easily replaced or introduced by integrating third party debtor management apps.

Take Debtor Daddy, for instance, which is a multi-faceted solution capable of sending out reminders, placing warning calls to debtors and collecting overdue charges. The appropriately named ezyCollect throws additional extras into the mix, such as automated debt escalation (from simple reminders to sending legal letters), integration with SMS and fax services, tracking emails, and the Pay Now button for invoices. Or there’s InvoiceSherpa, which collects debts, automatically applies late fees, provides discounts for early payments, and – as the cherry on top – integrates with all major accounting solutions from Xero and FreshBooks to QuickBooks Online and Sage One.

Zoltán G.

Zoltán G.

Adam B.

Adam B.

User feedback